Percentage of progress of the fourth Halving cycle.

0.00

Reached the block 840.000!

The line shows the percentage progress of the fourth halving cycle which ended at block 840.000. Each Halving cycle consists of 210.000 blocks.

What is the Halving?

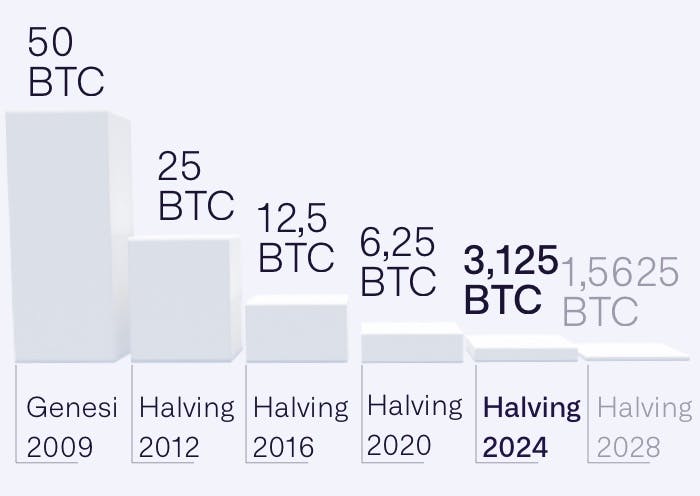

The Bitcoin Halving is the process of reducing the number of Bitcoins produced per mined block. It occurs approximately every 4 years - precisely every 210,000 blocks. In Bitcoin's history, we have already witnessed 4 Halvings: in 2012, in 2016, 2020, and the latest in 2024. This has reduced the number of Bitcoins generated per block from the initial 50 to 3.125 for the current cycle. This number will be further halved - reaching 1.5625 BTC per block - with the next Halving on 2028.

The Halvings over the years.

Why is the Halving important?

The Bitcoin Halving represents a crucial moment in the life cycle of the world's most famous digital asset. To fully understand the importance of this event, it's essential to start with a brief explanation of the Bitcoin mining process and the central role miners play. Mining is the process through which new Bitcoins are created by solving complex mathematical problems using specialized computers. When a miner successfully solves a problem by adding a new block to the blockchain, they are rewarded with a certain amount of new Bitcoin.

This reward is halved approximately every four years - every 210,000 blocks - through the Halving, a programmed and anticipated event in the Bitcoin code since its inception. In other words, the Halving reduces the rate of new Bitcoin issuance over time.

This mechanism is designed to limit the supply of Bitcoin and reduce Bitcoin's inflation rate to zero. Historically, the Halving has always had a significant impact on the price of Bitcoin. Typically, the reduced supply of new Bitcoin leads to an increase in demand, which can result in a price increase. However, the cryptocurrency market is complex and influenced by many factors, so the exact effect on price performance can vary.

This reward is halved approximately every four years - every 210,000 blocks - through the Halving, a programmed and anticipated event in the Bitcoin code since its inception. In other words, the Halving reduces the rate of new Bitcoin issuance over time.

This mechanism is designed to limit the supply of Bitcoin and reduce Bitcoin's inflation rate to zero. Historically, the Halving has always had a significant impact on the price of Bitcoin. Typically, the reduced supply of new Bitcoin leads to an increase in demand, which can result in a price increase. However, the cryptocurrency market is complex and influenced by many factors, so the exact effect on price performance can vary.